Summarize with AI:

Is Your Exchange Ready for 2026?

Crypto trading is entering its next growth cycle. The global exchange market is projected to reach $71.94 billion by 2029 and $213.15 billion by 2034, with derivatives growing fastest at an estimated 25.6% CAGR. Scale is rising, competition is accelerating, and performance expectations are increasing across every region.

In this environment, an exchange’s moat is not marketing. It is infrastructure. How well your matching engine performs, how safe your custody model is, how cleanly your integrations work, and how efficiently your platform operates will determine whether you grow into the next cycle or fall behind.

What Future Readiness Actually Requires

A future ready exchange is built on a resilient core. That means a high throughput matching engine for spot and derivatives, custody that is segregated and clearly governed, and APIs that partners trust. It also means reliable fiat rails, strong compliance workflows, and telemetry that shows where latency, liquidity, or reliability issues begin before users feel them.

Derivatives and Product Expansion

With derivatives set to outpace spot in growth, your architecture must support leverage logic, liquidation paths, and a scalable risk engine. Operators that treat derivatives as a later add-on often end up rewriting core systems. The platforms that win build this foundation early.

Modular Connectivity

Regulators in North America, Asia Pacific, and Western Europe expect different reporting, licensing, and data controls. A successful platform adapts without breaking. That requires modular components that can route orders, add liquidity sources, and integrate with both centralized and decentralized venues as policies shift.

Compliance and Observability

Compliance is no longer a back office concern. It is a requirement for product shipping and partner onboarding. Audit trails, role based permissions, travel rule support, and real time monitoring need to be built into the platform, not bolted onto it.

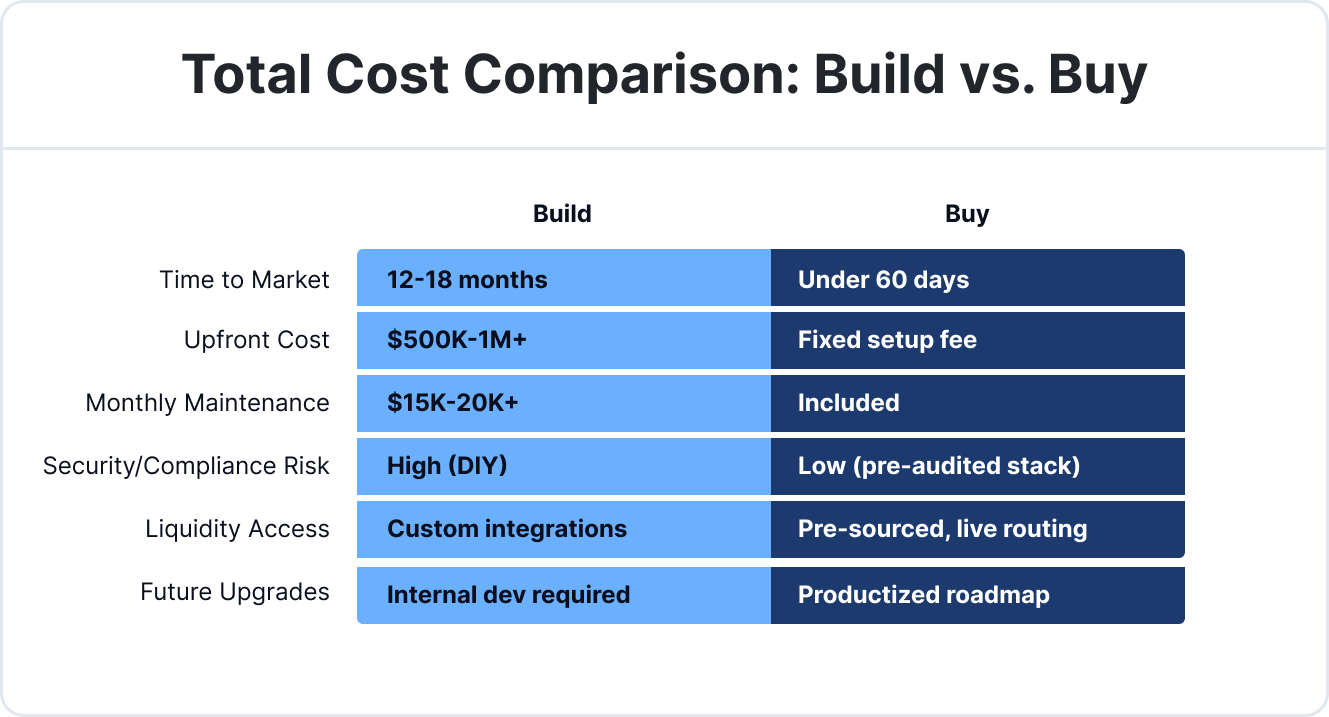

The Hidden Cost of Building In House

Building in house looks attractive when engineering resources are available. The reality is different. A realistic institutional grade build often takes 12 to 18 months, with development costs moving into the hundreds of thousands. Once live, hosting, DevOps, continuous monitoring, and security hardening create a monthly operational load that usually exceeds the cost of the initial build.

The Operational Burden

A production exchange does not sleep. Wallet logic, reconciliations, KYC flows, liquidation paths, alerts, and incident response must work every day. Any outage during volatility can damage brand credibility in a single event.

Security and Compliance

Hot wallet logic, withdrawal orchestration, and key policies require specialists. SOC readiness, audit trails, and licensing evidence are now prerequisites for banking partners. These are ongoing obligations, not one time checkboxes.

Engineering Drift

Teams that begin with a narrow MVP often become infrastructure teams by year two. The backlog shifts into perpetual futures, options, collateral models, routing improvements, and integrations. Product teams slow down and the roadmap loses momentum.

Why Licensing Proven Infrastructure Creates an Advantage

Licensed platforms change the equation because they deliver infrastructure that is already tested, already audited, and already carrying large volumes.

A modern white label solution can take a team from concept to launch in weeks. Matching engines, custody modules, KYC and AML workflows, admin controls, liquidity routing, and fiat rails come packaged and ready for production. This shortens certification, reduces unknowns, and allows your internal teams to focus on growth rather than infrastructure upkeep.

Speed With Reliability

You gain systems that have already handled live markets, volatility spikes, and institutional due diligence. Updates, patches, and compatibility checks with blockchains and banks are handled for you. That reduces risk and lets your roadmap focus on traders, not plumbing.

A Compounding Benefit

When the heavy lifting is covered, every UX improvement, funnel optimization, or marketing push compounds faster. Product teams shift from fighting fires to driving volume.

Choosing the Right Path

The decision to build or buy should match your strategy and the scale you expect to reach. If you build, budget for continuous operations, multiple annual security assessments, a dedicated DevOps cadence, and a compliance roadmap that satisfies partners. Be prepared to run an infrastructure organization, not just a trading platform.

If you license, select a provider with proven throughput, clear custody controls, strong APIs, transparent incident management, and a demonstrated record of shipping new product lines. Extensibility matters. Roadmap influence matters. Customization options matter.

Conclusion

Your infrastructure is the part of your product traders never see but always feel. With global exchange revenue projected to exceed $200 billion by 2034, the operators who invest in resilient foundations will be the ones who grow.

Building delivers control but demands years of engineering, significant ongoing cost, and constant operational readiness. Licensing a proven platform brings you to market faster, limits technical risk, and gives your team room to focus on growth, not infrastructure.

Shift Markets designs and operates exchange infrastructure that lets brokers launch quickly, scale confidently, and stay ready for what comes next. If your team is evaluating its path forward, we are here to show what future ready looks like in production. Request a demo and see how we can prepare your exchange for the next level.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!