Summarize with AI:

Key Takeaways:

-

Building your own exchange gives you full control but requires significant investment, long timelines, and ongoing operational responsibility.

-

Buying a licensed platform accelerates time to market, reduces risk, and allows your team to focus on growth rather than infrastructure.

-

The decision between build and buy is ultimately a tradeoff between ownership of complexity and speed with scale.

Build vs. Buy: The Hidden Cost of DIY Exchange Tech

In 2025, crypto infrastructure is no longer a side project. It is becoming a strategic priority for brokers and fintech operators worldwide. As more firms explore digital assets, a recurring question arises: should we build the platform in-house or work with a vendor?

For brokers with internal development teams, the instinct to build is understandable. Many have experience with custom CRMs, MT5 integrations, and proprietary dashboards. However, developing a crypto exchange requires a different level of complexity. The core issue is not technical skill. It is time, cost, and long-term operational scope.

This article outlines what an internal exchange build actually involves. It also highlights why many established brokers have chosen to license infrastructure rather than build from scratch.

The True Cost of Building Your Own Exchange

What begins as a development project often becomes a long-term operational commitment. Based on client experience and industry benchmarks, brokers pursuing an internal build typically face:

- $500,000–$1,000,000+ upfront cost for MVP development (matching engine, custody, KYC, frontend)

- 12–18 months of full-time engineering resources

- $15K–20K/month for ongoing DevOps and support costs

- Cross-team coordination debt across compliance, finance, and operations

Once live, an exchange becomes a 24/7 infrastructure business. Wallets, order books, funding flows, and margin logic must all operate without downtime or delay. These systems require continuous optimization, which is why dedicated exchanges maintain specialized product, engineering, security, and reliability teams over time.

The Risk Beyond the Budget

The technical scope of an exchange is only one part of the equation. The broader cost comes from the risk profile and operational exposure. While owning source code may appear to offer flexibility and control, it places full responsibility for platform security, performance, compliance, and long-term scalability on the operator. Without sustained investment, even a working product can fall behind. Latency, execution quality, admin limitations, and compliance gaps become harder to correct as technical debt grows.

Security and Compliance Risk

Crypto exchanges are constant targets for cyberattacks. Building internally means your team is solely responsible for patching vulnerabilities, securing wallets, and maintaining compliance across changing regulatory environments. Meeting licensing standards requires continuous investment in audits, access controls, and reporting infrastructure. They require continuous investment and long-term operational commitment.

The Talent Challenge

Exchange development demands specialized skills across custody, execution, compliance, and system reliability. Hiring qualified crypto engineers is both difficult and expensive. Many prefer roles at larger crypto firms or established exchanges. Even with strong internal teams, this type of development often redirects resources away from core brokerage products, delaying growth and increasing opportunity cost.

What Can Go Wrong: Common Failure Patterns

Brokers that attempt to build crypto exchange infrastructure in-house often underestimate the long-term risks. Wallet exploits are a common and costly outcome, particularly when hot wallet systems are built without crypto security expertise. One misstep in custody logic can lead to multimillion-dollar losses. Similarly, risk engines and slippage models developed from scratch are frequently misconfigured, resulting in incorrect margin calls, client disputes, and regulatory scrutiny. During high-volume events like token listings, custom-built platforms often crash under traffic spikes, disrupting trading and eroding client trust.

Beyond technical challenges, compliance and staffing gaps present major roadblocks. Institutional partners increasingly require SOC 2 compliance, which verifies that a platform meets stringent standards for security, availability, processing integrity, confidentiality, and privacy. Achieving SOC 2 is not just a checkbox, it requires comprehensive documentation, internal controls, regular audits, and real-time system monitoring. For most brokers, building this from the ground up can take up to 12 months and demand significant financial investment, legal input, and dedicated compliance resources. Without SOC 2, brokers risk delayed partnerships, failed due diligence checks, and lost revenue. At the same time, crypto-native engineers are in high demand and difficult to retain, especially in legacy brokerage environments where work often shifts from product innovation to infrastructure maintenance. These combined pressures make internal builds risky and difficult to scale.

The Buy Case: Ready in 60 Days, Built for Scale

Buying infrastructure does not mean giving up control. With the right solution, brokers can move quickly while retaining full ownership of their brand, fee structure, and user experience.

A licensed exchange platform provides:

- Full exchange infrastructure (spot + derivatives, KYC, custody, admin tools)

- Pre-integrated liquidity and routing across multiple venues

- Battle-tested performance under $200B+ in cumulative traded volume

- Built-in compliance readiness, including audit trails and permission controls

- Support and updates from a dedicated product team with exchange expertise

This approach allows brokers to enter the market faster, operate with confidence, and focus internal resources on growth rather than infrastructure.

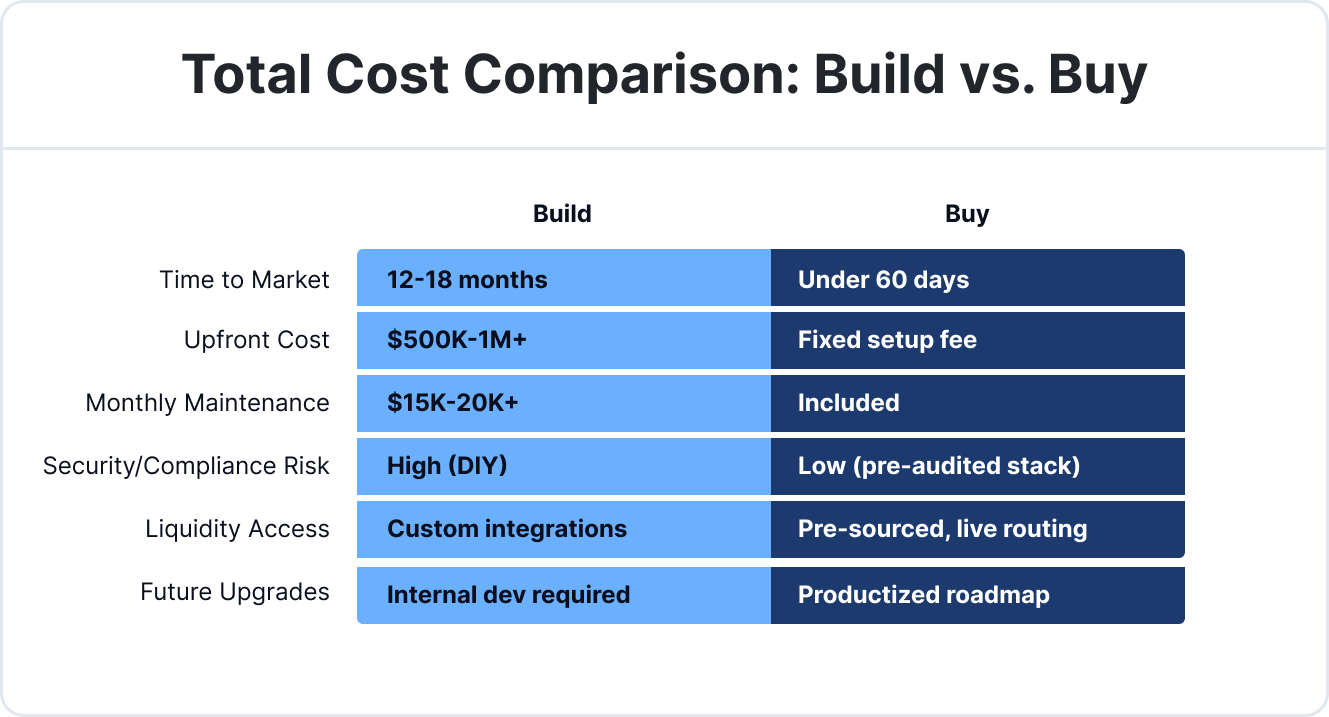

Total Cost Comparison: Build vs. Buy

The choice between building and buying comes down to speed, cost, and long-term responsibility.

While internal builds offer full ownership, they also introduce operational risk, resource strain, and slower time to market. Licensing shifts that burden to a dedicated infrastructure partner, giving brokers faster access to revenue without compromising on control or scale.

Conclusion: What Seems Cheaper Can Cost You More

The objection “we have our own dev team” often overlooks a core reality, engineering time is limited. Every month spent building infrastructure is a month not spent growing your brokerage or serving clients.

Licensing exchange technology is faster, reduces risk, accelerates go-to-market, and frees internal teams to focus on business outcomes. At Shift Markets, we turn crypto infrastructure into a ready-to-launch product that supports long-term revenue.

If your team is weighing a ground-up build, we’re happy to show you what’s already in place. Let’s connect.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!