Summarize with AI:

Asia, LATAM, MENA: Which Region Will Drive the Next Derivatives Boom?

Global derivatives trading has surged over the past three years as crypto adoption spreads beyond traditional hubs. The crypto derivatives market reached $4.5 trillion in 2024 and continues to rise as perpetual futures now make up 78% of all derivatives activity. While the US and Europe still shape regulatory narratives, they are no longer the center of growth. The next wave is coming from regions where retail appetite is high, alternative payment rails are mature, and traders demand more advanced products like perpetual futures and high-leverage markets.

Three regions stand out: Asia, LATAM, and MENA. Each one has the potential to drive the next derivatives boom, but for different economic, demographic, and structural reasons. Below is a breakdown of where momentum is building and what it means for exchanges preparing to scale.

Asia: The Global Powerhouse

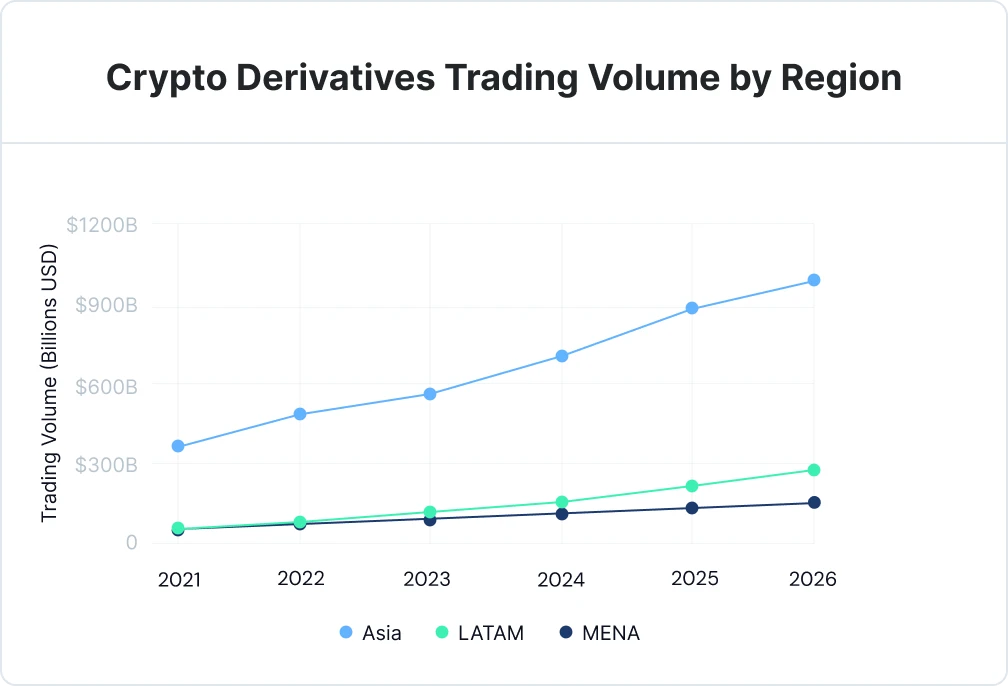

Asia has been the epicenter of derivatives trading for more than a decade. Today, it still leads in volume and sophistication, accounting for 45 to 48% of global crypto derivatives trading. In 2025, Asia remains the strongest economic engine in crypto derivatives. The region’s quarterly volume climbed from $420 billion in Q1 2022 to $890 billion in Q4 2025, showing continued leadership driven by liquidity depth and trading culture.

High Retail and Professional Adoption

Markets like South Korea, Japan, and Vietnam consistently top global crypto usage rankings. Retail traders remain highly active, and derivatives trading fits their appetite for liquidity and around-the-clock markets.

Deep Liquidity and Strong Local Exchanges

Futures platforms in East and Southeast Asia consistently rank among the highest globally. This drives strong liquidity, intense competition, and tighter spreads.

Payment Rails Built for Speed

Countries such as Singapore, Thailand, and Indonesia are rolling out instant bank transfers and QR-based systems that make it easy to move capital in and out of platforms.

Regulatory Clarity Improving

Japan and Hong Kong are building structured licensing regimes for derivatives businesses, unlocking safer access for retail and institutional traders.

LATAM: The Fastest-Upward Curve

LATAM is emerging as the most dynamic derivatives growth story. Economic volatility pushes traders toward crypto as both a hedge and an income opportunity. LATAM recorded $1.5 trillion in crypto activity between 2022 and 2025, with monthly trading volumes rising from $2.6 billion to more than 3 billion in 2024–2025. The region’s derivatives volume rose from $55 billion in Q1 2022 to $218 billion in Q4 2025. It is the steepest growth curve of all three regions and signals strong momentum for the next five years.

Currency Instability Fuels Demand

Countries like Argentina, Brazil, and Colombia see repeated currency fluctuations. Perpetuals and stablecoin-based trading give traders predictable exposure in unstable environments.

Crypto Payments are Mainstream

LATAM is one of the world’s most active regions for real crypto usage, from remittances to everyday payments. This creates a strong intake of new traders.

A Young and Active Trading Demographic

A large share of the population is under 35. This group gravitates toward mobile-first platforms and high-volatility products.

Growing Interest from FX Brokers

Regional FX firms are adding crypto derivatives to boost revenue and attract younger traders. This is accelerating demand for turnkey platforms and reliable liquidity.

MENA: The Institutional Upside

The MENA region combines rapid retail adoption with a growing institutional base. MENA holds 8 to 10% of global crypto market activity today and is scaling reliably. The region’s derivatives volume grew from $48 billion in Q1 2022 to $122 billion in Q4 2025, powered by regulatory clarity and institutional participation.

Government-backed Digital Asset Initiatives

The GCC has become a preferred destination for exchanges and infrastructure providers. Dubai’s frameworks support derivatives, while Saudi Arabia and Bahrain are opening markets for institutional crypto strategies.

Wealth Concentration and Investment Culture

High net-worth individuals and family offices are increasing exposure to leverage, structured products, and crypto-native hedging strategies.

Retail Adoption Rising Fast

Younger populations in Egypt, Turkey, and Morocco rely heavily on crypto as a store of value. These traders are increasingly active in perpetual contracts.

Growing Local Exchange Ecosystem

Regional platforms are expanding their perpetual futures and margin offerings as demand grows.

So Which Region Will Lead the Next Boom?

Asia will remain the global leader in crypto derivatives. Its liquidity base, infrastructure, and trader concentration are unmatched, with regional activity rising from roughly 420B to 890B over the period. That depth and consistency keep Asia at the center of global derivatives flows.

LATAM is set to deliver the strongest growth spike, with regional volume climbing from about $55B to $218B, driven by macroeconomic instability, rising stablecoin usage, and constant onboarding in high-inflation markets. MENA is shaping the strongest institutional wave, as licensing frameworks, capital concentration, and a growing exchange ecosystem pull in higher-value trading activity. Together, these regions drive different parts of the boom: Asia pushes scale, LATAM pushes adoption, and MENA pushes institutional maturity.

Conclusion

The next derivatives boom will not come from one region alone. It will be driven by Asia’s trading culture, LATAM’s economic urgency, and MENA’s institutional shift, and exchanges that plan around these patterns will capture the next wave of volume.

Whether you are entering Asia, scaling across LATAM, or building a licensed presence in MENA, Shift Markets provides the derivatives engine, liquidity access, and operational support you need. With deep liquidity across spot and perpetuals, configurable leverage, strong risk controls, and full Back Office oversight, you can launch in weeks. If you’re preparing to expand, connect with our team.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!