Summarize with AI:

Updated December 19, 2024

Key Takeaways:

-

Crypto derivatives offer traders a range of strategies for profit and risk mitigation. They enable leveraging market positions for potentially higher returns and provide hedging options to protect against market volatility. This dual role of risk and reward management is a critical aspect for traders in the highly volatile crypto market.

-

The primary forms of crypto derivatives trading encompass perpetual swaps, options, and futures contracts, each offering unique mechanisms and opportunities within the market.

-

Derivatives trading is best suited for advanced traders due to their intricate nature and the high level of risk involved. Proper understanding and strategic application of these instruments are crucial in succesfully navigating the crypto derivatives market effectively.

What Are Crypto Derivatives? A Guide by Shift Markets

For both novices and experienced traders in the quickly evolving cryptocurrency market, grasping the nuances of derivatives trading is essential. As a leading force in the fintech and cryptocurrency space, Shift Markets is delighted to present an insightful guide on crypto derivatives. This article aims to demystify the complex world of these financial instruments, which have significantly reshaped the landscape of cryptocurrency trading.

From the basic definition to the various types, including futures, options, and perpetual swaps, our guide will equip you with the essential knowledge to navigate the crypto derivatives market with confidence and proficiency. Whether you’re a trader looking to learn how to trade futures or an enterprise aiming to launch a derivatives platform, our comprehensive guide covers everything from the basic definition to the diverse types like futures, options, and perpetual swaps.

Why are Crypto Derivatives Important?

The importance of crypto derivatives in the modern financial landscape extends beyond mere trading instruments. These derivatives serve as vital tools for market stabilization, risk management, and enhancing overall market efficiency.

Crypto derivatives play a pivotal role in the price discovery process for cryptocurrencies. They enable traders to speculate on the future prices of these digital assets without the necessity of owning them directly. This speculative activity is crucial because it consolidates the collective opinions and expectations of market participants about the future value of a cryptocurrency. The trading of these derivatives, therefore, becomes a barometer for gauging market sentiment and establishing consensus about the asset’s value, even in a market characterized by rapid and often unpredictable price fluctuations.

Moreover, these financial instruments are key in managing risks. Traders and investors use derivatives to hedge their positions, protecting themselves against adverse price movements. For instance, holding a derivative that gains in value when a particular cryptocurrency falls can offset losses in a trader’s holdings. This hedging capability is particularly important for institutional investors and businesses that need to manage their exposure to the ever-present volatility in the crypto market.

Additionally, derivatives contribute significantly to the liquidity of the cryptocurrency market. They attract a wider range of participants, from individual traders to large institutions, by offering the potential for profit without the necessity of holding the actual digital assets. This influx of participants and the increased trading volume they bring help in creating a more liquid and expansive market.

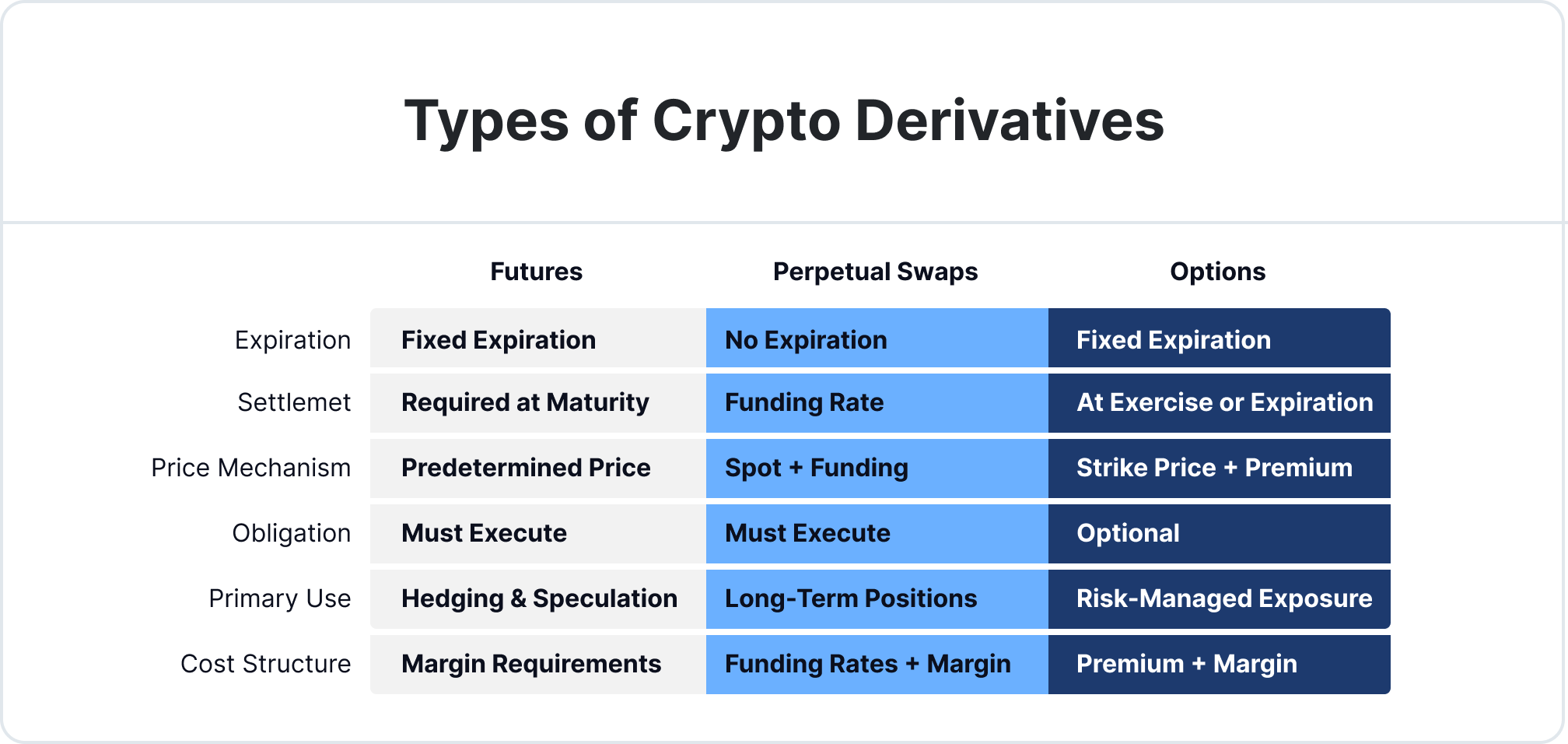

Types of Crypto Derivatives

An overview of futures, perpetual swaps, and options: features, uses, and cost structures compared.

Futures

Futures contracts are essentially speculative agreements where traders commit to buying or selling a digital asset at a specific price on a predetermined future date. The core operation of these contracts revolves around the anticipation of price fluctuations. Traders use futures to bet on the direction they expect the asset’s price to move. For instance, if a trader expects the price of an asset to rise, they would enter a ‘long’ futures contract, agreeing to buy the asset at a set price in the future, hoping to sell it at a higher market price later. Conversely, if they expect the price to fall, they might enter a ‘short’ contract, planning to buy at a lower price later.

Unlike perpetual swaps that have no expiry, futures contracts have a fixed expiration date, at which point the contract must be settled — usually in cash, not the actual asset being traded. This structured approach allows traders to speculate on and hedge against potential price volatility in the crypto market. However, it’s important to note that trading futures involves substantial risk, often amplified by the use of leverage, which can magnify both gains and losses based on the asset’s price movements.

Perpetual Swaps

Perpetual swaps in the crypto derivatives market offer a unique advantage due to their indefinite lifespan, unlike traditional futures contracts with set expiration dates. This feature allows traders to hold positions for as long as they wish, providing flexibility to respond to market changes without the transaction costs and potential slippage associated with rolling over futures contracts. They closely mimic the spot market price through a funding rate mechanism, aligning the perpetual swap price with the underlying asset’s market price. This makes them ideal for traders seeking to leverage their positions to capitalize on both short-term market fluctuations and long-term trends, without the constraints of predetermined settlement dates.

Options

Cryptocurrency options are flexible financial tools that give traders the right, but not the obligation, to buy (with call options) or sell (with put options) a crypto asset at a predetermined strike price, before a set expiration date. This flexibility makes them suitable for various strategies, such as hedging—where traders use put options to protect against potential declines in their crypto holdings—or speculation, where traders bet on the asset’s price direction with limited risk, confined to the option’s premium.

The option’s premium is pivotal, influenced by the asset’s current market price, the strike price, time until expiration, and the asset’s volatility. It represents the cost for the right to trade the underlying asset and reflects the market’s assessment of the likelihood of the asset reaching the strike price within the given period. Options in crypto trading, therefore, offer a calculated, risk-controlled way to engage in the market, whether for protective hedging or speculative purposes.

Use Cases for Crypto Derivatives

Crypto derivatives are versatile tools in the trading world, fulfilling distinct roles like hedging against risks, speculating on price changes, and generating income. These derivatives’ multi-functional nature caters to various trading objectives, making them more than just instruments for buying and selling.

Hedging, a crucial risk management strategy in crypto derivatives trading, involves using instruments like futures and options to offset potential losses in an existing position. For example, a trader holding Bitcoin in anticipation of a price increase might hedge against potential loss by taking a short position in BTC futures. This position would gain value if Bitcoin’s price drops, thus balancing out any losses from the initial spot market position. Similarly, a long put option on Bitcoin can act as a safety net, gaining value if Bitcoin’s price decreases and providing a buffer against market downturns.

In contrast, speculation in crypto derivatives is driven by predictions about price movements. Traders engage in this high-stakes aspect by taking long or short positions, depending on their expectations of whether the price will rise or fall. The use of leverage in options and futures magnifies both potential gains and losses, encapsulating the high-reward, high-risk nature of speculative trading in this domain.

In essence, trading in crypto derivatives transcends mere buying and selling, offering a sophisticated blend of strategies for the informed trader, each tailored to different market conditions and trading goals.

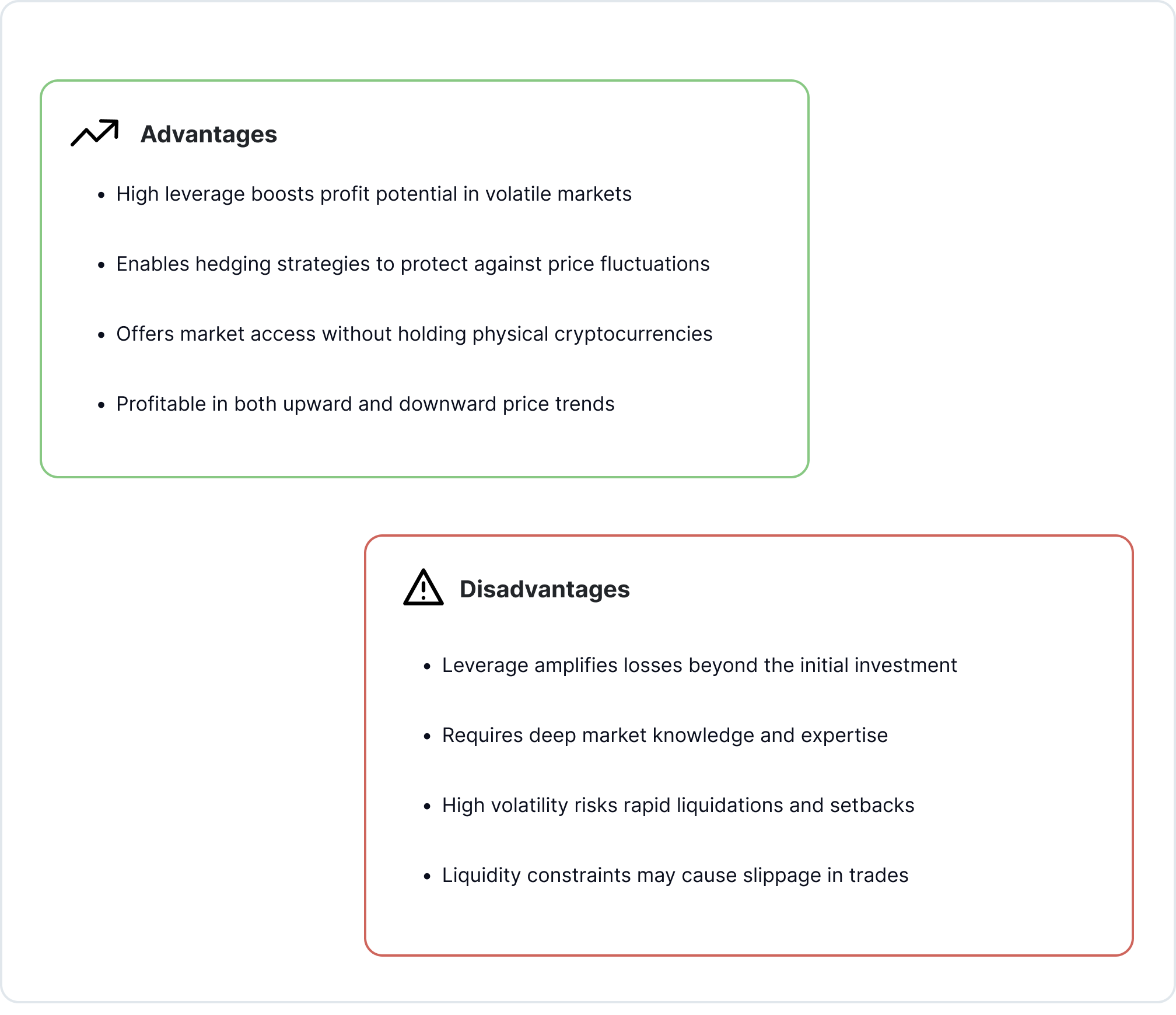

Advantages and Disadvantages of Trading Crypto Derivatives

Balancing high-profit potential with significant risks in crypto derivatives trading.

Balancing high-profit potential with significant risks in crypto derivatives trading.

Trading crypto derivatives involves a balance of high-reward opportunities and significant risks. It’s a complex yet potentially lucrative area, demanding careful strategy and an understanding of the volatile nature of the cryptocurrency market. Let’s delve into the specific advantages and disadvantages to provide a clearer picture of what traders can expect from this multifaceted trading strategy.

Higher Risk, Higher Reward

Trading crypto derivatives epitomizes the concept of high risk with the potential for high rewards. These instruments amplify profits significantly, offering greater returns than traditional trading, particularly in the historically volatile crypto market. The use of leverage, while increasing potential gains, also elevates the level of risk, making it a critical factor for traders seeking substantial rewards.

Derivatives are valuable for risk management, providing hedging opportunities against market fluctuations, especially for those holding large positions. This strategy not only protects investments but also opens avenues for profit during market downturns.

Additionally, crypto derivatives offer easier market access, bypassing the complexities of holding actual cryptocurrencies. This accessibility is paired with the ability to speculate on both rising and falling market trends, presenting unique profit-making opportunities in the fast-paced movements of the crypto market. In essence, the increased risks of crypto derivatives are counterbalanced by the prospects of higher returns, appealing to traders adept at staying afloat in these dynamic waters.

Hidden Pitfalls of Crypto Derivatives

Crypto derivatives trading, while offering significant opportunities, comes with notable challenges. The complexity of these instruments requires a deep understanding of market dynamics and the specifics of each derivative type, posing a steep learning curve.

Leverage, a key feature in crypto derivatives, amplifies both potential profits and losses. In the volatile crypto market, this can lead to rapid liquidations, with losses sometimes exceeding the initial investment. High leverage in a market known for sudden price swings can quickly escalate minor market movements into significant financial setbacks.

Liquidity can also be a concern, especially in less popular derivatives or during market turbulence, making it difficult to execute trades at desired prices.This lack of liquidity can lead to substantial slippage, where the execution price of a trade is different from the expected price, potentially resulting in larger-than-anticipated losses. Additionally, counterparty risk in over-the-counter trades introduces the possibility of financial loss if the other party fails to meet their obligations. In short, the complexities of these trading instruments require careful understanding, especially with the use of leverage, which can amplify losses severely.

Conclusion

In conclusion, crypto derivatives are powerful tools in the digital finance arena, offering advanced traders the opportunity to hedge risks, speculate on market movements, and generate income through various sophisticated strategies. However, the inherent complexities and risks associated with these instruments cannot be overstated. They demand a high level of market knowledge, risk tolerance, and strategic acumen.

At Shift Markets, we understand the pivotal role these derivatives play in the broader cryptocurrency landscape. We specialize in providing enterprise cryptocurrency software solutions that cater to the needs of modern traders and institutions. Our platform is designed to streamline trading processes, enhance market understanding, and support decision-making in this dynamic domain. We invite you to explore the potential of crypto derivatives further and enhance your trading capabilities with us. Learn more about our offerings and request a demo here.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!