Summarize with AI:

Key Takeaways:

-

Crypto funding enables instant margin top-ups, helping brokers reduce forced liquidations and preserve trading volume.

-

24/7 stablecoin deposits unlock weekend activation and reactivation, converting idle users when traditional rails are offline.

-

Lower processing fees, up to 80% less than cross-border wires—directly improve broker margins at scale.

3 Ways Crypto Funding Improves Broker Profitability in 2025

In 2025, brokers face tighter spreads, rising acquisition costs, and growing pressure to serve a global user base. Traditional funding rails no longer match the speed or flexibility that today’s traders demand. For forward-looking brokers, crypto-native payment options are no longer a novelty. They are a core driver of profitability.

Crypto payments are changing the economics of brokerage operations. With instant settlement, global reach, and dramatically lower processing costs, these rails offer clear advantages over cards, wires, and outdated gateways. Traders increasingly expect funding options that match the speed of the market, and the brokers who meet that expectation are capturing more volume, retaining more users, and improving margins in the process.

Why Brokers Are Moving to Crypto Funding

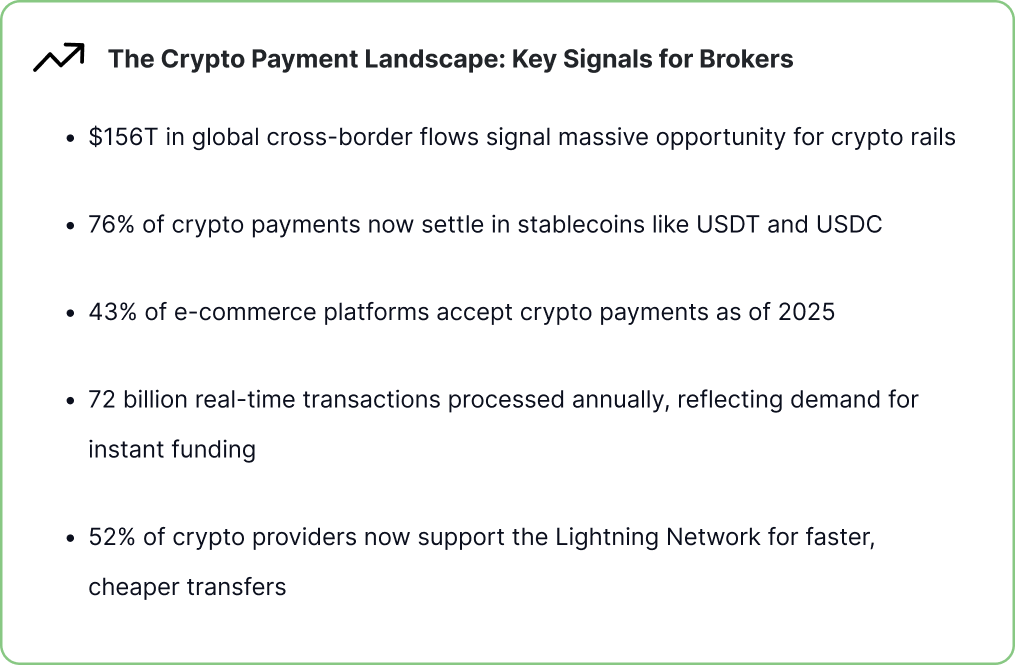

These signals point to a global shift in how users move and manage capital. For brokers, crypto payments are no longer speculative; they are strategic. From retail behavior to infrastructure upgrades, the market is making room for faster, more flexible rails.

3 Ways Crypto Funding Increases Profitability

Crypto rails allow faster capital movement, broader user activation, and significant cost savings. These are not incremental gains. They are structural advantages. Below are three ways crypto funding directly increases broker profit margins:

1. Faster Margin Call Response Means More Capital Preserved

It’s no surprise. Surveys show that more than 75% of retail traders using leverage encounter at least one margin call. Margin calls are a critical risk moment for traders and brokers. Delays in topping up accounts often mean forced liquidation, lost positions, and evaporated volume. Bank wires, especially cross-border, rarely settle in time to prevent damage.

Crypto funding changes the equation. With stablecoins and blockchain settlement, traders can react instantly, even during off-hours. This directly protects the broker’s bottom line. The market is moving this way fast: open interest in crypto margin products hit record highs in 2025, signaling the increasing demand for platforms that can support fast liquidity replenishment. Brokers that offer crypto top-ups reduce liquidation risk, preserve volume, and retain capital that would otherwise exit the system.

2. Weekend Activation and Retention Increases Conversion

Traditionally, weekends were dead zones for broker funding. Fiat rails went dark from Friday evening to Monday morning. Any trader looking to deposit, reactivate, or respond to market movement was out of luck.

Crypto rails never close. With 24/7 stablecoin support, brokers can capture deposit volume during precisely the times competitors go silent. The result is more first-time conversions, faster funding-to-trade cycles, and reactivation of previously idle users. This trend is trader-driven. Across forums and community channels, weekend deposit requests are becoming standard behavior. Market events that unfold on a Saturday are now tradeable, if the funding infrastructure is there. For brokers who enable it, the outcome is simple: higher activation, higher retention, and revenue when others are offline.

3. Lower Payment Processing Costs Improve Margins

Card processors, wire transfers, and payment gateways continue to chip away at broker profitability through fees, delays, and failed transactions. For international clients, these costs can become prohibitive. Crypto solves this at the infrastructure level.

In 2025, stablecoins made up 76% of all crypto payment volume, proof that traders now prefer fast, dollar-linked deposits over traditional bank methods. At the same time, more than half of payment providers now support Layer 2 networks, cutting settlement costs even further. Crypto payments reduce transaction fees by up to 80% compared to cross-border wires, bringing deposit costs down to 1% or less. That margin gets returned to the business, not to the bank. When your client base spans multiple currencies and geographies, these savings become significant at scale.

Crypto Payments Are a Profit Lever, Not Just a Feature

Crypto funding is no longer a checkbox. It is core infrastructure. Brokers that embrace it gain faster capital preservation, increased weekend trading volume, and improved margins across the board.

Shift Markets helps brokers turn this infrastructure into competitive advantage through CryptoPay, our crypto-native payment solution built for brokers. CryptoPay enables real-time stablecoin deposits, seamless onboarding, weekend activation, and fully integrated back-office reporting.

If your funding strategy is still tied to legacy rails, you are leaving profitability on the table. CryptoPay gives you the speed, flexibility, and economics modern traders expect — with none of the operational complexity. Shift Markets delivers the rails.

Ready to boost profitability with real-time crypto payments? Talk to our team and see how CryptoPay transforms your funding strategy.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!