Summarize with AI:

Key Takeaways:

-

Stablecoins are now essential infrastructure for FX brokers expanding into emerging and underbanked markets.

-

Stablecoin’s speed, low cost, and borderless accessibility make them a practical alternative to traditional banking systems.

-

Shift Markets’ CryptoPay enables brokers to activate stablecoin funding quickly and compliantly across LATAM, MENA, and Southeast Asia.

How FX Brokers Are Using Stablecoins to Unlock New Markets

In 2025, FX brokers are no longer just trading currencies, they are creating access to financial infrastructure in regions long underserved by traditional finance. To reach underbanked traders and expand into emerging markets, stablecoins have become the default USD rails: fast, scalable, and accessible.

Stablecoins such as USDT and USDC enable traders to move value across borders and platforms without relying on fiat banking systems. In regions like Latin America, the Middle East and North Africa, and Southeast Asia, brokers that integrate stablecoin funding are unlocking new user bases and solving real-world pain points. Shift Markets’ CryptoPay is built to help brokers turn this momentum into growth, by making these rails available with minimal lift.

Stablecoins at Scale in 2025

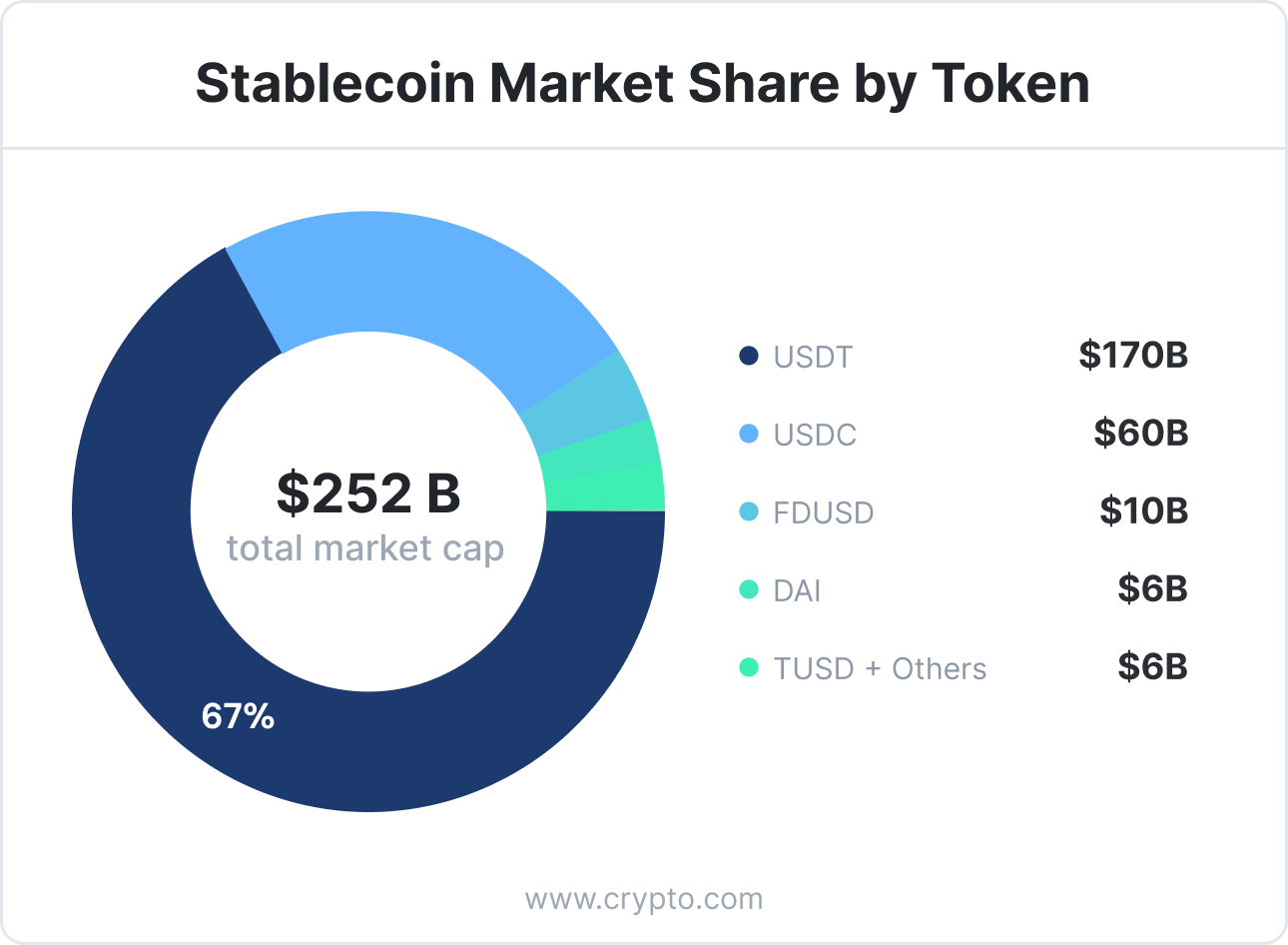

USDT and USDC control over 90% of the stablecoin market. This dominance makes integration with these tokens essential for brokers seeking liquidity, reliability, and broad user access.

Stablecoins have become the dominant force in on-chain activity. Daily transaction volumes reached $7 billion in 2025, an 8% increase year over year, while monthly volume surpassed $1.48 trillion, up 27% from the previous year. With over $230 billion in circulating supply, stablecoins now account for more than 60% of all on-chain transaction volume. Their usage extends far beyond trading, powering real-world applications like enterprise settlements, payroll, cross-border remittances, and everyday payments.

Regional Adoption & Market Signals

As stablecoins gain traction globally, their impact is especially visible at the regional level. From economic instability to limited access to dollar-denominated accounts, local conditions are accelerating adoption in unique ways. Here’s how this shift is playing out across key emerging markets:

Latin America (LATAM)

Latin America has become one of the most important regions for real-world crypto usage, especially in stablecoins. From 2021 to 2022, citizens across LATAM received over 562 billion dollars in digital currency value. Most of this volume was in stablecoins, driven by the need to hedge inflation and work around limited banking access. USDC settlements alone have surpassed 7 trillion dollars in LATAM, showing how stablecoins are now central to everyday payments, international remittances, and business-to-business flows.

Argentina and Brazil have emerged as global leaders in this shift. Each country recorded over 90 billion dollars in stablecoin inflows last year. The drivers are well understood. Macroeconomic instability, rapid currency devaluation, and restricted access to dollars have made stablecoins the digital dollar alternative of choice.

MENA

In MENA, they are transforming how traders and businesses interact with capital. Türkiye uses stablecoins as an inflation hedge. The UAE has embedded them directly into crypto gateways. In Saudi Arabia, youth adoption is growing fast, pushing brokers to offer more flexible funding methods. Regulatory support and maturing infrastructure have helped turn stablecoins into an operational tool rather than a speculative asset.

Southeast Asia (SEA)

In Southeast Asia, the numbers point clearly to institutional traction. More than 43% of all cross-border B2B payments in the region are now conducted using stablecoins. These payments are fast, cost-effective, and increasingly favored over traditional banking rails. The underlying infrastructure is also scaling. More than 80% of global stablecoin settlement volume on Ethereum and BNB Smart Chain flows through Asia. Combined with a global footprint of over 500 million active crypto wallets, this signals deepening usage across both retail and enterprise layers.

Why This Matters for FX Brokers

1. Underbanked Access Without Fiat Infrastructure

Stablecoins grant brokers immediate USD-equivalent funding to users without bank accounts or access to fiat rails. High adoption in LATAM and SEA makes this both relevant and essential.

2. Fast, Low-Cost Cross-Border Funding

Blockchain-native stablecoin transfers settle in seconds at minimal cost, solving latency and fee issues in regions where banks are slow or unreliable.

3. Compliance-Ready USD Dollarization

Stablecoins offer account transparency, reserve-backed stability, and align with AML/KYC frameworks,especially under MiCA and expanding global regulations.

CryptoPay: Your Global Stablecoin Bridge

Across the world, stablecoins are no longer an alternative, they are the infrastructure. From enabling USD access in inflation-hit economies to powering cross-border B2B payments, the evidence is clear: brokers who adopt stablecoin rails are reaching more users, moving capital faster, and reducing reliance on fragmented banking systems.

Shift Markets’ CryptoPay is purpose-built for this shift. It gives brokers instant access to USDT, USDC, and other dollar-pegged tokens, region-specific onramps tailored for LATAM, MENA, and SEA, and full fiat off-ramping, custody, and liquidity integrations. The platform is designed with compliance in mind, offering KYC/KYT support, audit-ready logs, and full transparency, through one unified global gateway.

Ready to meet demand across borders? Find out how CryptoPay helps brokers activate stablecoin funding without the integration burden.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!