Summarize with AI:

Tether’s $500B Play: What It Signals for the Future of Crypto

Tether is reportedly exploring a $20 billion funding round that could value the company near $500 billion, placing it among the world’s most valuable private firms. With more than $170 billion USDT already in circulation and Q2 2025 net income of $4.9 billion (a 277% year-over-year increase), Tether has become one of the most profitable firms in the sector. Backed by US Treasuries and growing Bitcoin reserves, its scale signals that stablecoins are no longer a niche utility, they are core to global financial infrastructure.

Why the Market Cares

The stablecoin market has already surpassed $300 billion in capitalization and could top $1 trillion by 2028, fueled by real-world adoption. Nearly half of B2B payments in Southeast Asia already settle with stablecoins, and 90% of surveyed institutions report they are integrating them into settlement and treasury operations.

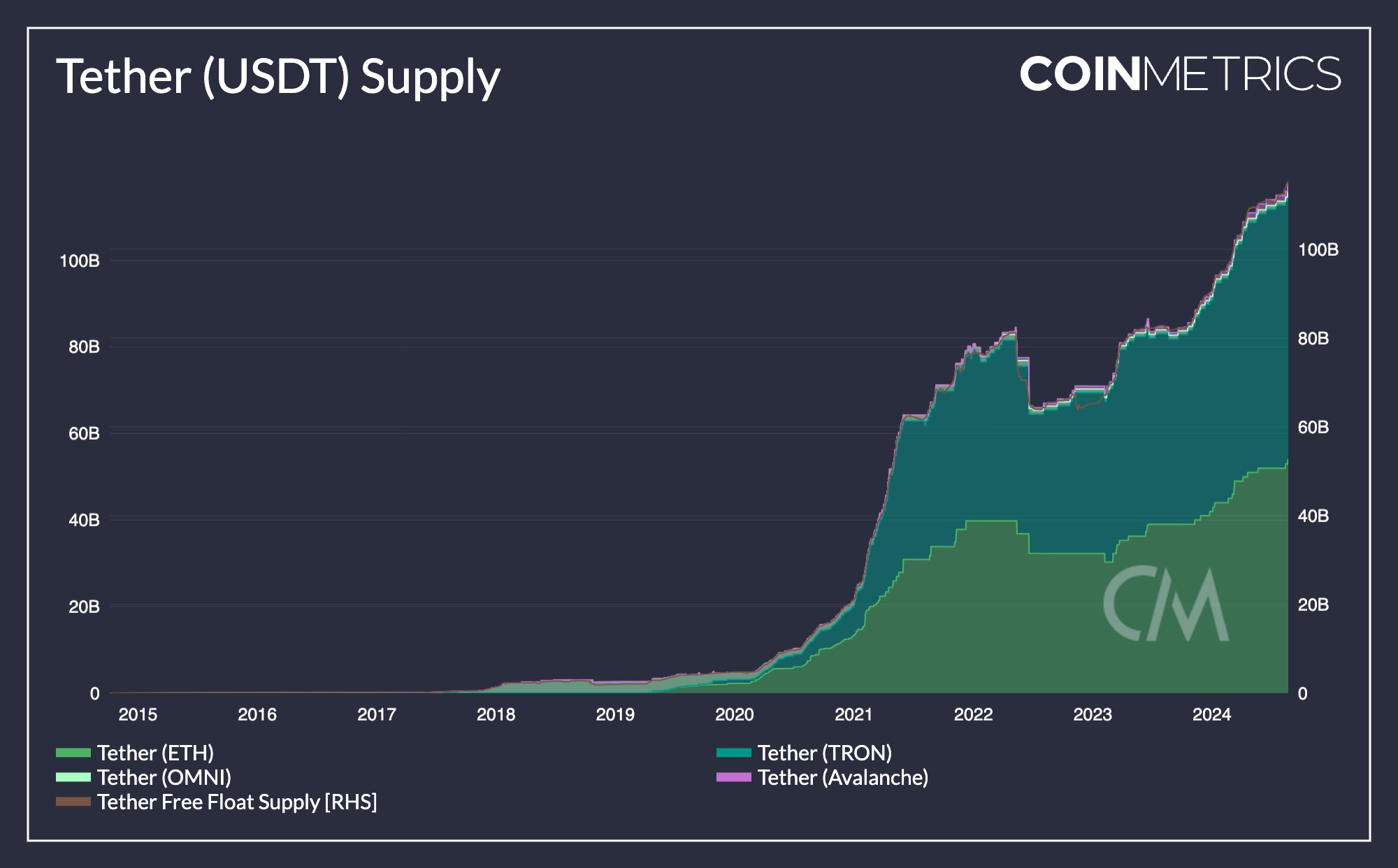

Since 2020, USDT supply has surged from under $5B to more than $100B across chains like Ethereum, Tron, and Avalanche. Tron in particular has captured much of the recent demand thanks to low-cost transfers. Even during market downturns, Tether’s supply held firm and then rebounded, proving its resilience. The sharp climb since 2023 reflects accelerating institutional and retail adoption, clear evidence that stablecoins are no longer niche, but a core liquidity driver for global trading platforms.

The Ripple Effects of a $500B Valuation

A Tether valuation of this magnitude isn’t just about one company. It would cement stablecoins as a pillar of the financial system, influencing everything from how central banks approach regulation to how brokerages structure client funding.

Analysts warn of “cryptoization”, where deposits shift out of banks into stablecoin wallets, reducing central banks’ control over interest rates and currency stability. At the same time, new European bank-backed euro stablecoins and MiCA-aligned projects highlight that competition is heating up, not slowing down

The Opportunity for Exchanges and Brokers

Stablecoins unlock real growth. They shorten time to first trade, keep clients active, and create a clear path to derivatives and new fee lines.

Faster Growth Levers

Stablecoins cut time to first trade, enable instant funding, and keep clients active when FX is closed. With 24/7 settlement, activation, retention, and volume all lift.

Revenue and Product Expansion

Stablecoin rails open a clear path to derivatives and new fee lines. Add perps, futures, and margin where licensed to deepen engagement and ARPU.

Operating Standards for Scale

Pair stablecoin rails with licensed tech, integrated liquidity and smart routing, hardened custody with small hot wallets and HSM, and end to end compliance. KYB, KYC, KYT, audit trails, and real time monitoring are now table stakes for institutions.

The Path Forward

Tether’s push toward a $500B valuation shows that stablecoins are becoming the backbone of global funding and trading. With $170B in circulation and profits rivaling banks, Tether proves stablecoin adoption is reshaping liquidity at scale.

It becomes clear that platforms that integrate stablecoin flows into custody, trading, and risk systems will scale faster, retain clients longer, and unlock new fee lines through derivatives. At Shift Markets, we’ve seen how putting stablecoins at the center shortens launch timelines and drives growth. Connect with our team to join the next wave of winners in FX and crypto.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!