Summarize with AI:

Shift Markets’ Proprietary Market Maker

At the core of every trading operation is the need for deep liquidity and optimal trade execution. Shift Markets’ proprietary Market Maker addresses these needs by connecting platforms to the world’s leading exchanges, providing unparalleled liquidity from day one. This advanced solution enables the creation of synthetic pairs and aggregated orderbooks, expanding market depth and trading opportunities. By leveraging Shift’s market maker, exchange platforms can offer unique trading pairs, competitive pricing, and a reliable trading environment, ensuring they stay ahead in the increasingly competitive crypto industry.

The Importance of Market Making in Crypto Trading

Market making is essential for providing the liquidity that underpins efficient and effective trading operations. By consistently quoting buy and sell prices, market makers ensure that traders can readily enter and exit positions, promoting a smooth trading environment. This continuous flow of orders helps stabilize asset prices, reducing volatility and enhancing market attractiveness.

In the crypto market, where liquidity can be less predictable than in traditional markets, market making plays a pivotal role in maintaining price stability and fostering investor confidence. Effective market making improves price discovery and ensures that trades are executed efficiently, supporting the overall growth and stability of crypto trading platforms.

The Problem: Challenges in Market Making and Liquidity

Many crypto exchanges struggle with poor market making, insufficient market depth, and inadequate liquidity sourcing. These issues lead to significant challenges, such as high price volatility and inefficient trade execution, making the trading environment less attractive to investors. Poor market making results in wide bid-ask spreads, causing traders to incur higher costs and reducing overall trading activity. Additionally, inadequate market depth means that large orders can significantly impact prices, creating a less stable and predictable market.

These challenges have far-reaching consequences. Exchanges may experience lower trading volumes, reduced investor confidence, and an inability to attract institutional clients who require a stable and liquid trading environment. These problems hinder the growth and competitiveness of crypto trading platforms, preventing them from reaching their full potential. Recognizing these critical challenges, Shift Markets has developed a proprietary Market Maker designed to address these issues and provide an effective solution for optimizing trading operations.

The Solution: Shift’s Proprietary Market Maker

Shift Markets’ Market Maker tackles the issue of poor market making by ensuring continuous liquidity through connections with the world’s leading exchanges, including Coinbase, Binance, and Kucoin. By aggregating liquidity from multiple sources, our platform narrows bid-ask spreads, reducing trading costs for users and encouraging higher trading volumes. This enhanced liquidity provision stabilizes prices and creates a more attractive trading environment for institutional investors.

To combat inadequate market depth, Shift Markets’ Market Maker employs advanced algorithms to create synthetic pairs and aggregated orderbooks. These features allow for the creation of unique trading pairs and deeper order books, enabling large orders to be executed with minimal price impact. This not only improves price stability but also makes the exchange more appealing to high-frequency traders and institutional clients who demand reliable and predictable trading conditions.

Additionally, our Market Maker ensures efficient trade execution by leveraging top-tier liquidity sources and sophisticated technology. This combination enables exchanges to offer competitive pricing and resilient liquidity even during periods of high market volatility or when individual liquidity providers face issues.

Full Control Over Your Liquidity

The ability to manage your own liquidity is essential for the long term success of any trading platform. Shift Markets’ Market Maker allows you to retain complete control over your liquidity and trading pairs, a freedom that many platforms lack. Some providers may lure you in with little or no setup fees, but they have a hidden agenda—enforcing royalties on your trades and limiting customization options. This effectively turns you into a marketing engine for their platform, while they take a significant portion of your revenue.

Shift Markets offers a different model—no revenue splits, no restrictions on your liquidity, and full autonomy over trading operations. With our Market Making platform, you’re empowered to grow your business on your own terms, free from unnecessary dependencies.

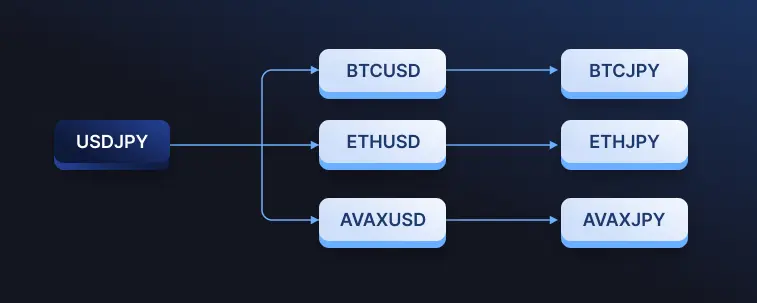

The Power of Synthetic Pair Creation

The capacity for synthetic pair creation within Shift Markets’ Market Maker opens up massive value potential for exchange operators. Through enabling the formation of unique trading pairs that do not exist naturally, exchanges can offer a broader range of assets to their users, attracting a more diverse and engaged client base. This feature allows platforms to tap into less liquid or exotic markets, providing traders with opportunities that are unavailable elsewhere.

Synthetic pairs also facilitate innovative trading strategies, as traders can leverage correlations between different assets to maximize their returns. Moreover, the ability to create synthetic orderbooks ensures that even if one leg of a trade lacks a full orderbook, the market remains vibrant and liquid. This flexibility significantly enhances the trading experience, making the exchange more competitive and appealing to both retail and institutional investors.

This diagram illustrates synthetic pair creation, where a base currency pair is combined with other pairs to form new trading pairs. This expands trading options and improves liquidity by leveraging existing pairs.

The Advantage of Aggregated Orderbooks

Aggregated orderbooks are a cornerstone feature of Shift Markets’ Market Maker, providing substantial benefits to exchange operators. By combining liquidity from multiple top-tier exchanges, our platform offers the best possible prices and spreads to users. This results in a more competitive trading environment, where traders can execute orders at optimal prices with minimal slippage. The deep liquidity pools created through aggregated orderbooks also mean that large orders can be accommodated without significantly impacting market prices, which is crucial for maintaining price stability and attracting high-volume traders.

Moreover, aggregated orderbooks ensure continuous liquidity even if one liquidity provider faces an outage or connectivity issue. This redundancy guarantees that trading operations remain smooth and uninterrupted, enhancing the reliability and trustworthiness of the exchange. By providing access to a rich, multi-sourced orderbook, Shift Markets’ Market Maker enables exchanges to offer a superior trading experience, ultimately driving higher trading volumes and fostering a more active and engaged trading community.

This diagram illustrates the aggregation of BTC/USDC order books from Coinbase and Crossover into a single, combined order book that offers the best prices and spreads. Aggregated order book ensure that traders can access optimal trading conditions by leveraging liquidity from multiple sources.

Meeting Higher Liquidity Needs in Derivatives Trading

Derivatives trading exchanges require significantly more liquidity than spot exchanges due to the larger positions and higher trade volumes involved. The complexity and diversity of derivative products, such as futures and options, demand continuous liquidity to ensure efficient pricing and minimize slippage. Shift Markets’ Market Maker is uniquely engineered to meet these high liquidity needs for both spot and derivatives trading.

By connecting to multiple top-tier exchanges and creating aggregated orderbooks, our technology ensures that liquidity is always available for large, leveraged trades. This enables advanced trading strategies and reliable execution, ensuring that large positions can be executed efficiently with minimal price impact. By delivering deep and consistent liquidity, our Market Maker empowers exchanges to handle the demands of both spot and derivatives trading seamlessly.

Closing Thoughts

Market making remains the keystone of successful crypto trading operations. The Shift Platform’s native Market Maker addresses the critical challenges of liquidity, market depth, and risk management, providing an all-encompassing solution for optimizing trading platforms. By embodying these principles, Shift Markets’ Market Maker sets the standard for excellence in crypto trading.

For those seeking advanced market-making solutions, reach out today to receive a personalized demo and experience Shift Markets’ platform in action. Upgrade your trading operations by leveraging our proprietary Market Maker.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!