Summarize with AI:

Updated April 14, 2025.

How to Get a Cryptocurrency License in the UAE

Key Takeaways:

-

The UAE offers a clear and structured licensing framework through regulators like VARA and ADGM, making it one of the most crypto-forward jurisdictions globally.

-

Securing a license requires a minimum capital deposit, a corporate bank account, and a full suite of compliance documents tailored to your chosen jurisdiction.

-

Once approved, licensed businesses gain legal authority to operate and access to a rapidly growing digital asset market across the Middle East and beyond.

Shift Markets has been guiding enterprises through the process of securing cryptocurrency licenses around the world for over a decade. During this time, we’ve witnessed the United Arab Emirates (UAE) emerge as a global leader in the digital currency landscape, setting ambitious standards for innovation and regulation. For businesses looking to penetrate this thriving market, obtaining a crypto license in the UAE represents a pivotal milestone that unlocks unmatched advantages and operational success.

In this quick guide, we’ll outline the essential requirements and steps to acquire a crypto license in the UAE. Whether you’re an ambitious startup or an established firm keen to explore the UAE’s crypto domain, the insights provided here will equip you to confidently navigate the country’s sophisticated regulatory framework.

Why Launch a Crypto Business in the UAE?

The UAE offers a crypto licensing regime that sets it apart from other global jurisdictions. Foremost, the country’s well crafted regulatory structure provides businesses with an exceptionally stable and secure environment for their operations, reducing the crypto-related compliance uncertainties that plague many other regions. The UAE is strategically positioned as a global business hub grants licensed crypto enterprises access to emerging markets across the Middle East, Africa, and Asia. Key advantages include:

Stable Regulatory Framework

Backed by authorities like VARA (Dubai), FSRA (Abu Dhabi), and the SCA (mainland UAE), crypto firms benefit from clearly defined guidelines for virtual asset activity.

Global Connectivity

Situated between East and West, the UAE provides access to markets across the Middle East, Africa, and Asia.

Tax-Friendly Ecosystem

Free zones offer 0% corporate tax, and the UAE imposes no personal income tax—allowing crypto firms to reinvest and scale efficiently.

Forward-Thinking Government

National blockchain strategies, crypto-friendly zones, and partnerships with firms like Binance show the UAE’s long-term commitment to digital assets.

Understanding the UAE’s Crypto Tax Landscape

The tax benefits available in the UAE are also highly compelling. With no corporate or personal income taxes levied on companies operating within free zones, licensed crypto businesses can optimize their financial planning and enjoy significant cost savings compared to other jurisdictions.

The UAE’s tax landscape for cryptocurrency businesses grants remarkable advantages that make the country a favorable environment for digital currency enterprises. Notably, the UAE imposes no federal income or corporate taxes on companies whose primary activities involve cryptocurrency trading or payment processing, allowing them to benefit from a 0% tax rate.

However, it’s important to consider the 5% Value-Added Tax (VAT) on general transactions, introduced in 2018. While cryptocurrency operations might largely be exempt, activities deemed as regular transactions could fall under VAT. Traversing this nuanced tax framework requires careful financial planning and compliance to optimize obligations within the UAE’s regulatory landscape.

The Significance of VARA for Crypto Businesses in Dubai

Understanding of the Virtual Assets Regulatory Authority (VARA) is required for enterprises venturing into Dubai’s cryptocurrency market. Established as the regulatory cornerstone for virtual assets within the emirate, excluding the Dubai International Financial Centre, VARA oversees the framework and regulations governing the virtual asset space. Its inception and the subsequent introduction of the Virtual Assets and Related Activities Regulations 2023 underscore VARA’s commitment to economic sustainability, stringent Anti-Money Laundering (AML) standards, and investor protection.

VARA has established a two-step licensing process for Virtual Asset Service Providers (VASP). Initially, firms must submit an Initial Disclosure Questionnaire and additional documentation to receive Initial Approval, allowing them to finalize legal and operational setups. After receiving Initial Approval, firms can apply for the VASP License by providing further detailed documentation and paying necessary fees, leading to the issuance of the license with potential operational conditions.

This structured licensing process streamlines the entry of crypto companies into the market, providing them with a clear path to compliance and operational readiness. By reducing bureaucratic obstacles and offering detailed regulatory guidance, VARA facilitates a smoother transition for companies adapting to Dubai’s dynamic crypto environment.

Requirements and Precursors to Filing

Let’s take a closer look at the key prerequisites and operational guidelines to cryptocurrency licensure in UAE.

License Acquisition Costs

The financial commitment for entering the UAE’s crypto market includes a state application fee of $25,000 to $50,000 , alongside a requirement for share capital starting from $100,000. Additionally, businesses must account for a 9% corporate income tax on profits above AED 375,000 (for companies operating outside of free zones), an annual supervision fee of $50,000, and adhere to sustainability and physical office requirements.

Foundational Documentation and Verification

Entrepreneurs are required to submit personal identification documents, such as passport copies, as part of the foundational requirements. This step is critical for the UAE’s rigorous AML & CFT (Combating the Financing of Terrorism) compliance, which also demands thorough customer identity verifications through a rigorous registration and documentation collection process.

Demonstration of Financial Resilience

Companies must show they have adequate funds to cover all operational expenses for a period of six to twelve months. This requirement is set to ensure the longevity and stability of the business amidst the volatile nature of the cryptocurrency market.

Encryption and Data Protection

The UAE mandates the use of advanced encryption technologies and multi-factor authentication systems such as end-to-end encryption, multi-factor authentication (MFA), and secure wallet infrastructure. In many cases, regulators will request documentation outlining these protections and may require regular security audits to maintain compliance post-licensure secure virtual assets and sensitive customer information, safeguarding against unauthorized access. Your crypto operation must have these safeguards in place, and the regulatory body of the UAE will verify that they meet their standards.

The 5 Step Process for Obtaining a Crypto License in UAE

Let’s walk through the general steps of obtaining crypto licensure in the UAE including associated costs where applicable:

Step 1: Choose Your Local Jurisdiction

The first major step is selecting from the UAE’s key jurisdictions, each offering distinct advantages for your crypto business:

Dubai Multi Commodities Centre (DMCC): Provides a the largest UAE ecosystem for trade and enterprise with a special focus on commodities trade and a strong regulatory framework for crypto businesses.

Dubai Airport Free Zone Authority (DAFZA): Offers strategic location advantages with access to airport logistics and a supportive environment for new technology and crypto businesses.

Abu Dhabi Global Market (ADGM): Features a strong international financial center with a clear regulatory framework specifically designed for fintech and crypto companies, promoting a secure business environment.

International Free Zone Authority (IFZA) in Fujairah: Stands out for its cost-effectiveness and ease of business setup, making it an attractive option for startups and small to medium-sized crypto businesses.

Dubai World Trade Center (DWTC): Offers a prime location for international businesses and events, with a commitment to becoming a comprehensive zone for virtual assets, including partnerships with major players like Binance.

Each zone offers unique benefits that can align with different business models and strategic objectives within the crypto space, so make sure to choose wisely.

Step 2: Prepare a Detailed Business Plan and White Paper

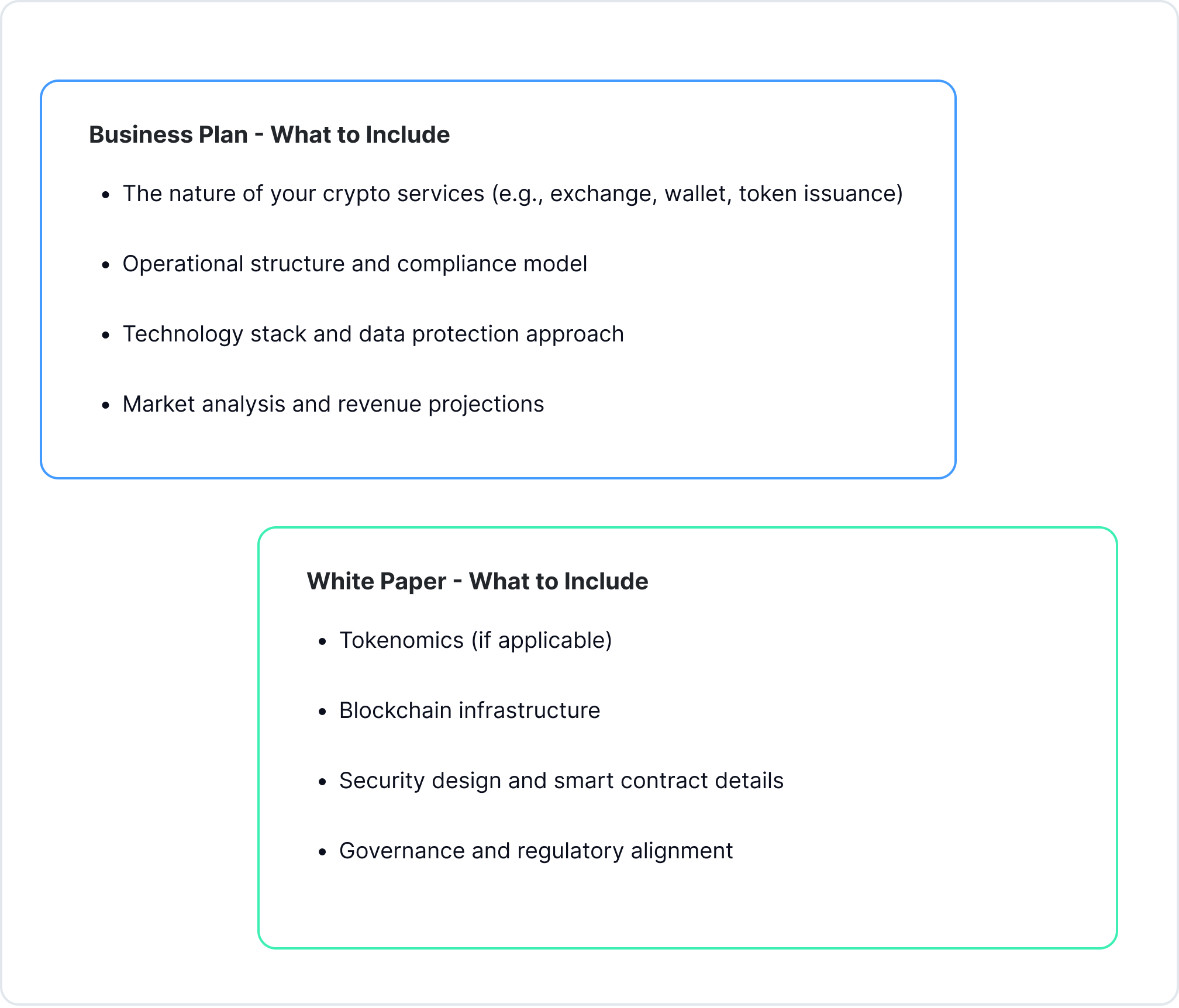

Key items to include in your business plan and white paper.

Crafting an all-inclusive business plan and white paper is essential for crypto businesses seeking licensure in the UAE. Your business plan should delve into specifics such as your crypto services, technology stack, operational workflow, market analysis, and financial projections.

The white paper, meanwhile, should detail the technical aspects of your crypto products or services, showcasing your innovation and adherence to best practices in security and compliance, as this level of detail significantly influences the approval of your license application.

Step 3: Corporate Bank Account Opening

Opening a corporate bank account in the UAE is a critical step and typically requires an initial capital deposit. While the exact amount varies by bank and jurisdiction, most crypto-related entities are expected to deposit at least $100,000 USD to demonstrate financial solvency. Due to heightened due diligence requirements for virtual asset businesses, applicants should be prepared to submit detailed company documentation, undergo screening, and align with compliance protocols before the account is approved.

Step 4: Compilation of Required Documentation

Once your business structure and banking are in place, compile all required documentation for submission. This includes your business plan, financial projections, white paper, passport copies of shareholders and directors, AML/CFT policies, office lease agreement, and proof of capital. Documentation requirements vary across jurisdictions such as VARA, ADGM, and DMCC, so it’s important to tailor your submission to the specific expectations of your chosen regulator.

Step 5: Application and Finalization for a Crypto License

With your documentation ready, submit your application to the relevant regulatory authority, along with the required non-refundable fee, which typically ranges from $25,000 to $50,000 USD. Your submission will undergo a detailed review, where regulators evaluate compliance measures, operational preparedness, and financial standing. Once approved, you may be asked to fulfill final conditions—such as paying supervisory fees or providing supplementary materials—before receiving your official license, allowing you to begin legally operating your crypto business in the UAE.

Following submission, you will enter the review phase, where patience is key as the authority assesses your application against its compliance and operational benchmarks. Once approved, be prepared to address any final requirements or fees, which could include consultancy charges or additional documentation, to receive your official license. This last step officially sanctions you to commence your cryptocurrency operations within the UAE, marking the culmination of your application process. Congratulations!

Conclusion

Obtaining a cryptocurrency license in the UAE is more than a regulatory requirement—it’s a gateway to operating within one of the world’s most progressive digital asset ecosystems. With its clear licensing framework, favorable tax environment, and strategic global positioning, the UAE continues to attract forward-looking crypto businesses ready to scale.

By following the structured process outlined in this guide and meeting the UAE’s regulatory expectations, companies can establish a strong foundation for long-term growth. As a trusted partner with deep expertise in global licensing, Shift Markets is here to simplify the process, minimize complexity, and help your crypto venture succeed in the UAE. Get in touch with our team to begin your expansion today.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!