Summarize with AI:

Updated October 11, 2024.

How To Create A Stablecoin: A Guide by Shift Markets

In the fast-paced world of cryptocurrencies, stability is highly sought after. Stablecoins—a type of digital currency anchored to real-world assets like fiat currencies or commodities—offer the combined benefits of cryptocurrencies and traditional financial tools. Learning how to create a stablecoin can seem like a daunting challenge, but we’ve created a guide to simplify and breakdown the essential steps in developing and issuing your own stablecoin.

Understanding Stablecoins: The Beacon of Stability

Stablecoins are digital currencies designed to minimize the notorious price volatility often associated with cryptocurrencies. Pegged to stable assets like fiat currencies, By pegging their value to stable assets, they provide a steady value, making them an ideal choice for diverse financial applications, from payments and remittances to decentralized finance (DeFi) and corporate treasury management.

Embarking on a Creating a Stablecoin: Why Bother?

From an entrepreneurial perspective, launching a stablecoin can be incredibly profitable due to several reasons:

Transaction Volume and Fees

Stablecoins encourage frequent transactions and high trading volumes due to their stability, leading to increased transaction fees. Stablecoin issuers can collect a small fee for each transaction, which, in a large-scale usage scenario, accumulates to a significant revenue stream.

Interest on Reserves

A key profit avenue for stablecoin entrepreneurs is the interest earned on reserve assets. Typically, when a stablecoin is created, it’s pegged to a stable asset, such as the US dollar. To maintain this peg, its value is backed by equivalent reserves held in trust or custodial accounts. Consequently, this setup allows entrepreneurs to generate steady income through the interest earned on these reserves.

Liquidity Provision and Trading Revenue

Stablecoin issuers can provide liquidity to exchanges by offering their stablecoins, earning a share of the trading fees generated from the trades involving their stablecoin. As a result, this liquidity provision role can be highly, financially rewarding.

The Lucrative Realm of Stablecoins

The stablecoin market is poised for explosive growth, projected to reach a staggering $3 trillion within the next five years. This presents an opportune moment to position yourself at the forefront of this financial evolution. In a time of rising interest rates, stablecoins are increasingly seen as a profitable and sustainable business model.

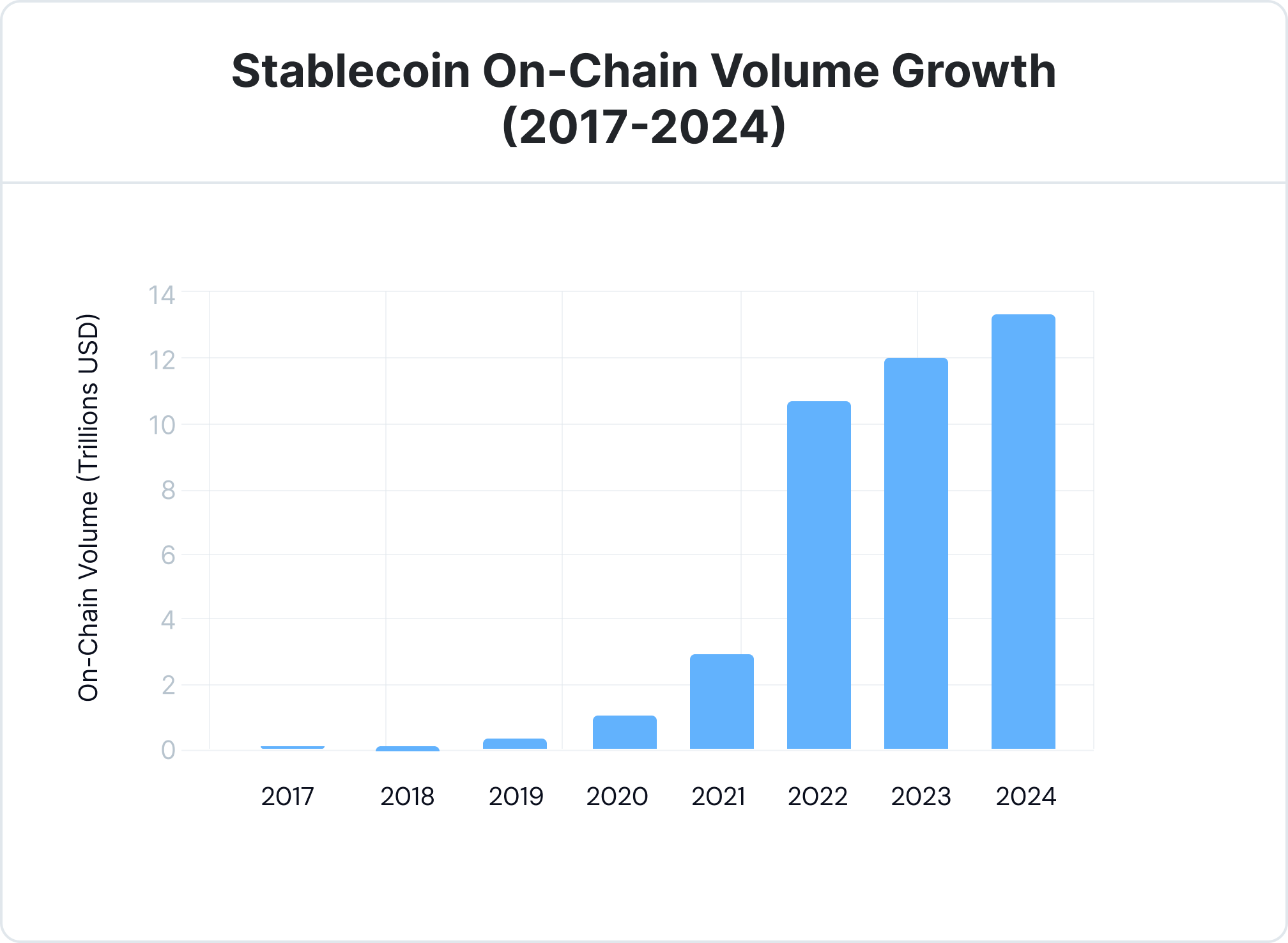

Explosive Growth: Stablecoin On-Chain Volume Surges from 2020 to 2024, Reaching Over $12 Trillion Annually

The Comprehensive Guide: How to Create A Stablecoin

Understanding how to create a stablecoin involves a series of critical steps and decisions. Let’s dive into each step meticulously:

Step 1: Choosing the Right Stable Asset

The first key step in launching a stablecoin is choosing an appropriate stable asset. It’s crucial to select an asset with stable value, broad recognition, and high trust in financial markets. Common choices include major fiat currencies like USD or EUR, or commodities like gold. Working with financial experts or economists can provide insights into the best asset choice. This collaboration helps lay a solid foundation for the stablecoin’s stability and success.

Step 2: Picking the Perfect Blockchain Infrastructure

Selecting the right blockchain platform is a crucial step in creating a stablecoin. Indeed, this choice significantly affects the security, scalability, and interoperability of the stablecoin. For example, established platforms like Ethereum, Binance Smart Chain, and Solana are often preferred due to their proven track records. However, the chosen blockchain must align with the stablecoin’s goals and technical needs. Consequently, this alignment ensures a strong foundation for both operation and growth.

Step 3: Assessing Liquidity Requirements

Ensuring adequate liquidity is essential to maintain your stablecoin’s stability and value. Assessing liquidity requirements involves carefully analyzing the anticipated user base, transaction volumes, and the platforms where the stablecoin will be traded. It’s crucial to work closely with financial analysts or liquidity providers to pre-source liquidity. This collaboration ensures your stablecoin remains sufficiently collateralized and can maintain its peg to the underlying asset, fostering trust and usability.

Step 4: Building a Secure Smart Contract

The creation of a secure and efficient smart contract is a critical step in the stablecoin development process. Smart contracts, based on blockchain technology, underpin the functioning of your stablecoin, defining its rules and operations. Developing a robust smart contract requires collaboration with experienced blockchain developers and thorough auditing to identify and mitigate potential vulnerabilities. Ensuring the security and integrity of your smart contract lays the groundwork for a stable and reliable stablecoin.

Step 5: Bringing Your Stablecoin to Life

Bringing your stablecoin to life involves a phase of intense development, testing, and refinement. Skilled developers work on coding the stablecoin, ensuring it meets the desired specifications, functionality, and security standards. This phase is crucial for shaping your stablecoin into a reliable digital asset, preparing it for market launch. Rigorous testing and refining are conducted to guarantee a seamless user experience and a stablecoin ready for adoption.

Step 6: Crafting a Strategic Marketing and Adoption Plan

Successfully executing the launch of a stablecoin extends beyond its technical aspects, necessitating a robust marketing and adoption strategy. Crafting this plan involves highlighting the advantages and use cases of your stablecoin to attract a diverse user base and potential investors. Effective communication through various channels, such as social media, industry partnerships, and targeted campaigns, is vital. Educating your userbase on the practical applications of your stablecoin is key to driving interest, adoption, and long-term success.

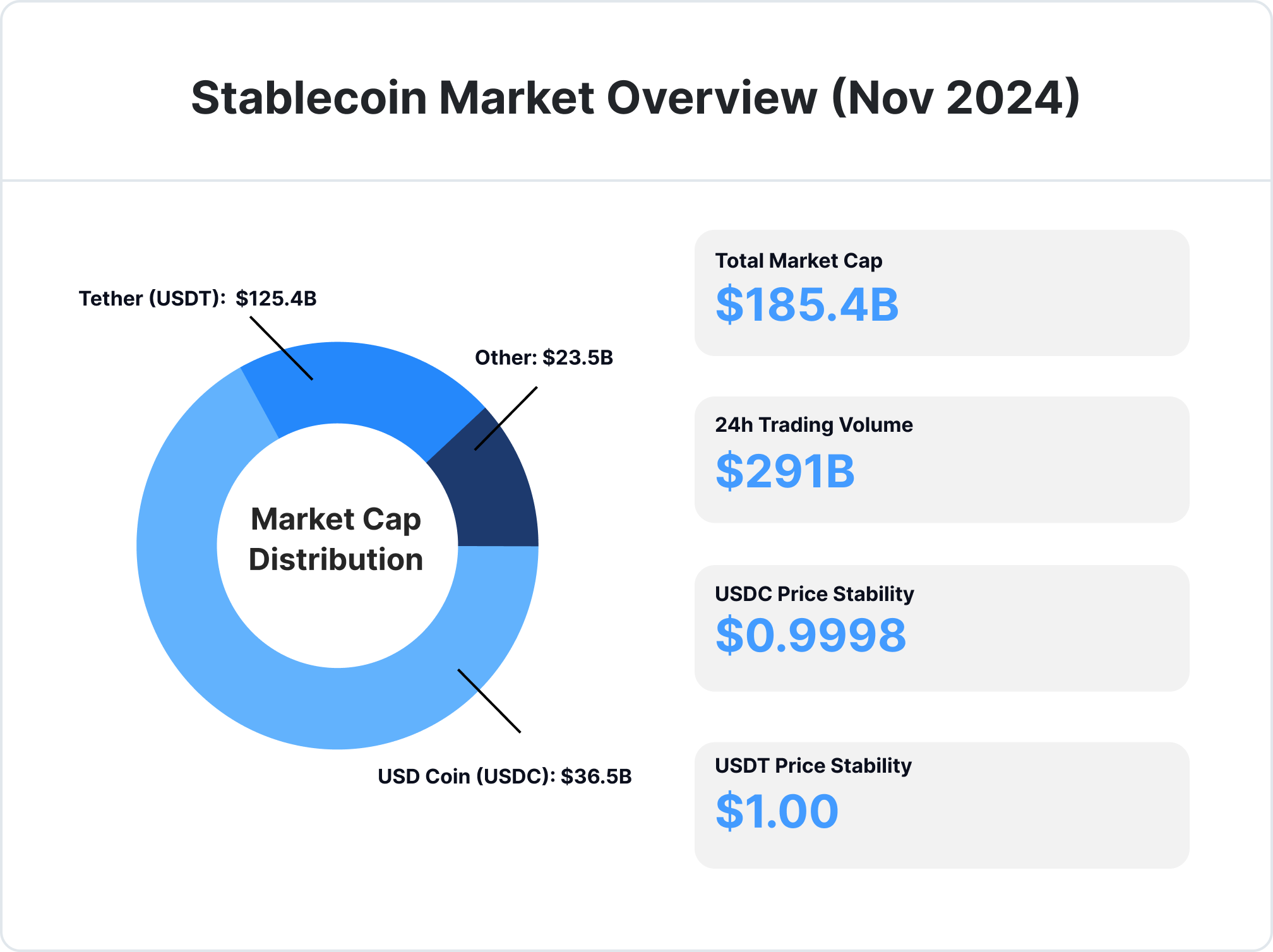

Stablecoin Market Snapshot: USDT & USDC dominate with $162B combined market cap.

Lucrative Stablecoin Opportunities in 2025

As the stablecoin market continues to mature, 2025 promises a range of lucrative opportunities for both new and established issuers. With increasing adoption across sectors and regions, stablecoins are set to expand beyond traditional use cases, unlocking new avenues for revenue and market influence.

DeFi-Native Payment Processing Platform

Launch a service enabling e-commerce merchants to accept stablecoin payments with instant settlement and lower fees than traditional payment processors. Integrate with major shopping platforms and offer automated currency conversion to local fiat, targeting emerging markets where traditional payment infrastructure is expensive or unreliable.

Remittance Network for Southeast Asian Corridors

Build a stablecoin-powered remittance network focusing on high-volume corridors like Philippines-Singapore and Indonesia-Malaysia. Partner with local convenience stores and mobile money operators for last-mile cash pickup, offering better exchange rates and faster settlements than traditional money transfer operators.

Supply Chain Financing Platform

Develop a platform using stablecoins for invoice factoring and inventory financing for SMEs in global trade. Focus on sectors with long payment terms like textiles or electronics, offering faster access to working capital through tokenized invoice discounting and automated repayment tracking.

Real-World Use Cases in 2025

As the stablecoin market continues to mature, 2025 promises a range of lucrative opportunities for both new and established issuers. With increasing adoption across sectors and regions, stablecoins are set to expand beyond traditional use cases, unlocking new avenues for revenue and market influence.

Crypto.com Stablecoin Integration with ETFs

Crypto.com’s 2025 plan to launch a stablecoin and integrate ETFs signals the expansion of stablecoins into traditional finance. By tying stablecoins to major indices and regulated assets, this integration aims to attract institutional investors seeking stability and compliance. The move is expected to drive trading volumes and offer new revenue streams by bridging digital and conventional financial products.

BBVA to Launch Stablecoin with Visa Partnership

BBVA is set to enter the stablecoin market by 2025, partnering with Visa to create a digital asset primarily for exchange settlements. The Spanish bank is exploring backing options, such as deposits or fiat currencies like the euro, while focusing on Europe’s stablecoin regulatory environment. BBVA’s stablecoin project reflects its longstanding commitment to digital assets and aims to leverage the tokenization of traditional assets for enhanced digital exchange value.

Surge in Global Interest for Central Bank Digital Currencies

Central banks in 134 countries are actively developing digital currencies, with 66 in advanced stages. CBDCs aim to modernize payment systems, enhance currency control, and offer public digital payment options alongside private stablecoins. Together, CBDCs and stablecoins drive the shift toward stable-value digital assets that bridge traditional and digital finance.

Closing Thoughts

Learning how to create a stablecoin is not an easy under-taking. In the competitive realm of stablecoin issuance, a reliable partner is essential. Shift Markets’ unique blend of regulatory expertise, industry experience, and unparalleled liquidity access positions it at the forefront of stablecoin success.

For issuers seeking seamless trading and compliance, Shift Markets offers robust solutions. Our team’s expertise, coupled with a strong liquidity network, ensures your stablecoin integrates smoothly and complies with global standards. Partner with Shift Markets to build a stable, well-supported stablecoin for the future. Reach out today to learn more.

FAQ: Creating a Stablecoin

1. What is a stablecoin?

A stablecoin is a digital currency designed to minimize volatility by pegging its value to assets like fiat or commodities. This stability makes stablecoins ideal for payments, remittances, and decentralized finance (DeFi) applications.

2. Why create a stablecoin?

Creating a stablecoin offers revenue opportunities, such as transaction fees, interest on reserves, and liquidity provision. Additionally, it enables businesses to expand their offerings and improve market positioning in a growing digital economy.

3. How can I ensure my stablecoin remains pegged to its asset?

De-pegging can occur due to insufficient reserves, market shocks, or technical failures. To prevent this, issuers should maintain adequate collateral, conduct regular audits, and implement mechanisms like algorithmic adjustments or collateral management to stabilize value during volatility.

4. What is the role of smart contracts in stablecoin creation?

Smart contracts automate the rules and operations of a stablecoin, ensuring secure transactions and compliance. Collaborating with experienced blockchain developers and conducting audits are essential for avoiding vulnerabilities.

5. What are some innovative use cases for stablecoins?

Stablecoins can power loyalty programs, enable microtransactions, and serve as digital assets in tokenized ecosystems. They are also used for payroll in multinational companies to reduce transfer times and fees.

Disclaimer: We are not financial advisors. The content on this site is for educational purposes only. Please consult a professional advisor before making any financial decisions.

Share this article:

Want to learn more?

Let us save you time by walking you through what Shift can do for your business!